SSFP- Sunzen Safety First Plan

SSFP — the Sunzen Safety First Plan — is a high-yield, insurance-backed investment strategy designed for individuals who seek stable long-term income, capital safety, and market-independent returns.

SSFP stands for Sunzen Safety First Plan — a long-term investment plan designed to help you achieve financial freedom through passive income and wealth creation.

It’s a smart, structured solution that combines:

- 50% Debt Allocation for stability and predictable returns

- Market-linked Growth tailored to your risk appetite

- Insurance-backed Security for added protection

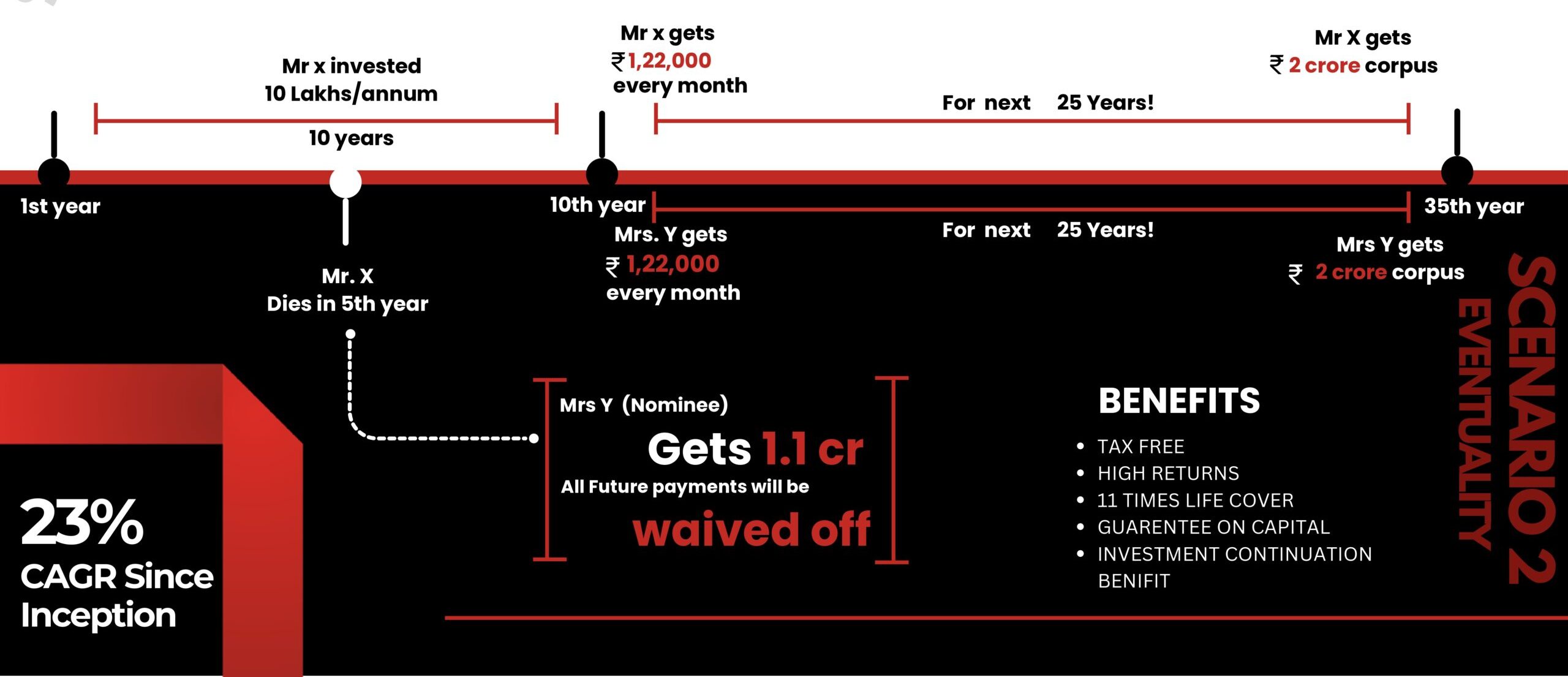

- Passive Income for 25 years after a 10-year investment period

- Lump Sum Corpus at the end of the plan

How it works:

What Do You Get with SSFP?

25 Years of Passive Income

Lump Sum Corpus

10X Life Cover Protection

Direct Investments, No Middle Handling

Capital Protection

Tax-Free Benefits

• Tax-Free up to ₹10 Lakhs per year for Indian residents.

Why Invest Through Us?

At Sunzen, we don’t just offer a plan — we walk with you through every step of your financial journey.

Request a Call Back

Frequently Asked Questions

Your Queries, Our Replies

No, SSFP is a long-term plan and withdrawals are restricted to encourage disciplined investing.

50% of your investment is in debt instruments with predictable returns. The remaining portion is market-linked and may vary depending on market performance.

Absolutely not. We have partnerships with reputed investment and insurance companies. Your money goes directly into their bank accounts through secure, verified channels.

No. The allocation is customized based on your individual risk appetite and financial goals.